“Central Europe benefits from the advantages of having Germany, Europe’s economic engine, as a neighbour. German companies, especially those in the automotive industry, have been moving manufacturing to these countries for a number of years and there is no signal that the process is about to stop. It is a positive sign that they build highly sophisticated operations here: gone are the times when Central Europe was just a workshop where cars were assembled from components developed elsewhere,” says Ferdinand Hlobil, Head of the Central European Industrial Team at Cushman & Wakefield.

István Fazekas, Head of Industrial at Cushman & Wakefield in Budapest added: “Automotive industry is clearly the driving force of the Hungarian economy and it is still a growing business segment which is proven by the expansion of the existing market players as well the new requirements coming from their suppliers. As a result, the logistics market clearly benefits from the accelerated activity of the manufacturers and it will have a positive effect on the vacancy rate long term which has increased significantly in the past years.”

The industrial space take-up reached a record last year and companies’ interest in the region can be expected to continue. Almost 4 million square metres of modern industrial space was let last year in the Czech Republic, Poland, Hungary, Slovakia and Romania.

“The companies investing here also include those from other parts of the world. They benefit from the highly qualified workforce and locate their new product research and development in these countries. I should of course also mention warehousing or logistics operations, especially those related to the development of e-shops. For them, the key factors are the low price and the cheap workforce coming from countries further east,” adds Hlobil.

More than 2.8 million square metres was taken up in Central Europe in 2012. The previous record was 3.2 million square metres, taken up in 2011. Ten years ago the annual figure was around 500,000 square metres.

LARGEST OCCUPIERS IN THE COUNTRIES OF CENTRAL EUROPE

COUNTRY

TENANT

LEASED SPACE (sq m)

Czech Republic

DHL

420 000

Hungary

DHL

103 000

Poland

Amazon

325 000

Romania

Continental Tyres

108 000

Slovakia

DHL

151 000

Source: Cushman & Wakefield

* 50,000 existing area + 58,000 square metres under construction

New development

Developers are responding to occupiers’ requirements, which are changing with the development of internet shopping and with the increasing interest in green features in buildings. Nevertheless, the quality of the site, the workforce, infrastructure and the costs of the lease remain the main criteria of selection. The area of new development was almost 690,000 square metres last year, remaining at around the average for the last four years. Just for comparison: in 2012 the newly built area was about 740,000 square metres.

“The market has stabilised at about 700,000 square metres of new development per year. Newly arriving companies are able to take up this space. We do not expect the annual figures to return to the record levels of 2007 and 2008, when they amounted to almost 2.5 million square metres. At present, the market is very well-balanced and transparent, which is good for occupiers and developers, as well as investors,” says Ferdinand Hlobil.

Take-up and rental rates

Over the past three years, the proportion of vacant space has been at the healthy level of 10 per cent (the average for the entire region). If there is not a substantial setback, the take-up rate can be expected to remain stable this year. This is associated with the basic rental level, which is around 3.5-3.7 euros/square metre, on average, depending on how attractive each location is and on the vacancy rate at the site.

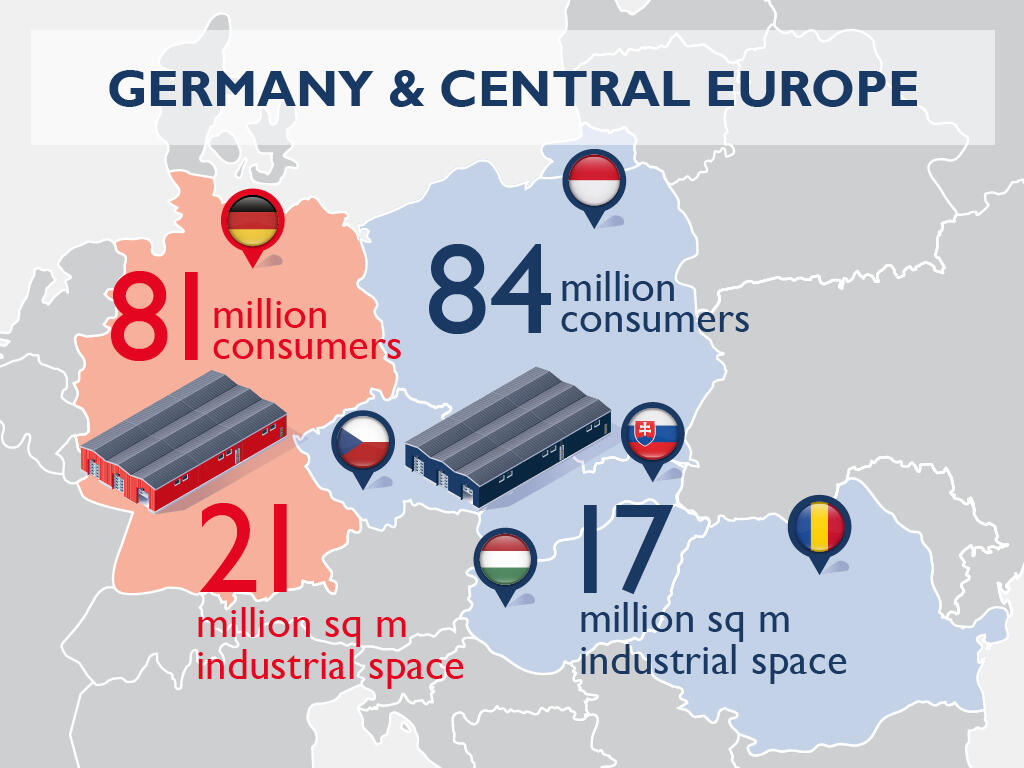

The total stock is at 16.5 million square metres of modern industrial space in Central Europe at present.

New trends

Central Europe has a considerable economic and purchasing power. The region is increasingly more attractive to both manufacturers and logistics businesses. Companies entering the region pay little attention to national borders. Manufacturers’ expansion plans are primarily based on criteria such as the quality, availability, price and loyalty of workforce. In logistics the key criteria are the catchment area and the distance to customers. Central Europe’s future, therefore, lies in close cooperation.

“For cities like Wroclaw and Liberec or like Katowice and Ostrava, joint marketing can be more productive than competition. It is better for a company to get a complete package of information about a local region than to fish for information from various sources. A region that is well-prepared and is responsive to investors has a much better chance to attract investments,” says Ferdinand Hlobil.

Cushman