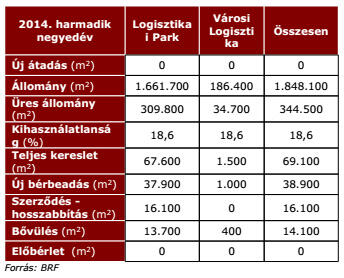

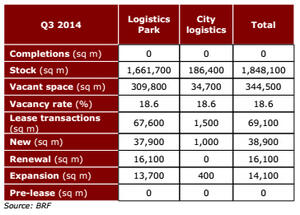

Total leasing activity amounted to 69,100 sq m, almost half of the level registered in Q2 2014 and 3% less than a year ago. On the other hand, take-up statistics (volume of lease agreements excluding renewals) showed more positive signs, reaching 53,000 sq m, representing 54% year-on-year growth. In contrary to the previous quarters of 2014, renewals had a share of only 23% within the total leasing activity. The largest new deal was signed in Prologis Park Budapest-Gyál where a logistics company established its first Budapest-based distribution centre with 22,100 sq m of space. The largest expansion took place in BILK with 11,700 sq m. Pre-lease agreements were not registered.

In Q3 2014, 20 industrial transactions were concluded with an average deal size of 3,455 sq m. 98% of the leasing activity was registered in logistics parks, where the average size was up to nearly 4,000 sq m, almost the same size as in 2013 and H1 2014.

As the market was characterised by relocations in Q3, the strong take-up did not translate into high net absorption. In fact, the vacancy rate remained unchanged from the previous quarter, standing at 18.6%. However, on a yearly basis a substantial improvement can be witnessed with a 4.7 pps drop in the vacancy rate on the back of a annual-to-date net absorption of 94,500 sq m. At the end of Q3 2014, vacancy rates in city logistics and logistics parks were at the same level.

CBRE