Despite this commitment to real estate investment, one notable change has been a decline in investors’ appetite for risk. After three years of diminishing popularity, prime or core assets are back on the agenda. The proportion of investors who see prime or core assets as the most attractive part of the market has jumped from 29% last year to 41% in 2016. This is partly explained by investors’ concerns over economic issues. When asked the question “What poses the greatest threat to property markets in 2016”, global economic weakness was seen as the greatest threat (31%), with domestic economic problems (14%) a distant second.

Diverging investor views were prevalent in the responses given for the most attractive country for real estate investment. Germany was the most frequent choice as investors’ preferred destination, with 17% of all responses. The UK was in close second place with 15.1%, followed by Spain (10.2%), Netherlands (9.9%), France (9.2%) and Poland (9.2%). More importantly however, is the fact that this was by far the closest result of any of CBRE’s seven surveys, with many more markets coming into the mix this year.

There was also a big uplift in interest in Central and Eastern Europe (CEE). When taken as a group, CEE markets saw their proportion of preference rise from 6% in 2015 to 23% this year. This can partly be explained by investors’ continued “search for yield”. In H2 2015 prime yields in continental Western Europe fell very sharply and this has resulted in the yield gap between CEE and Western Europe increase markedly, raising CEE’s attractiveness to real estate investors.

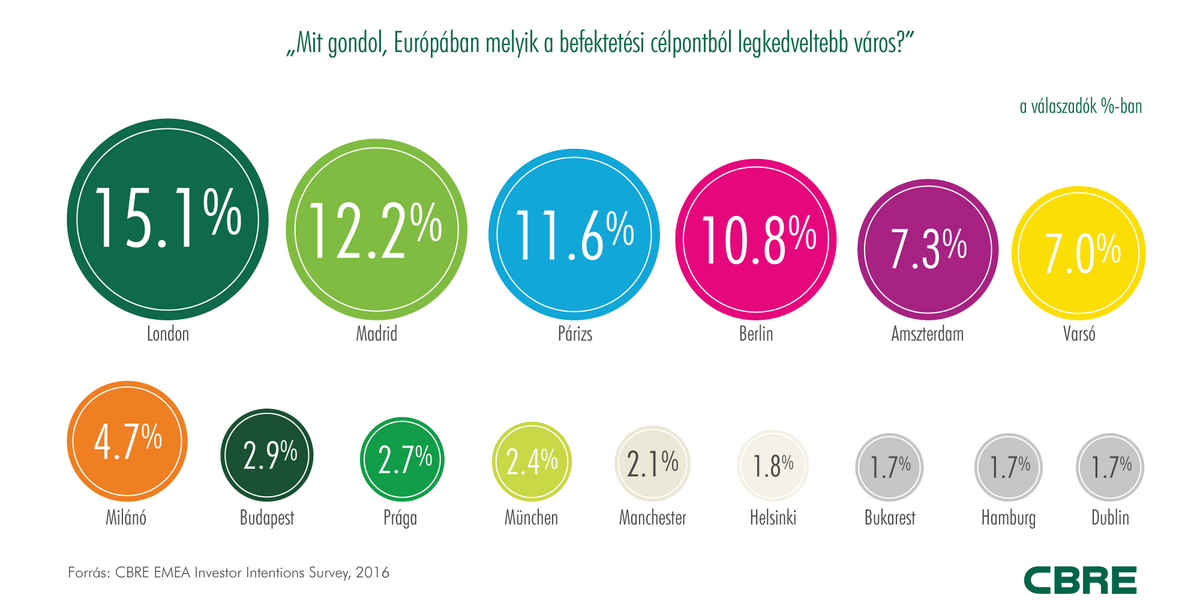

At a city level, London retained its preferred status, with 15.1% of all investors favouring the city, but the gap between London and other cities is closing. Madrid came second with 12.2%, closely followed by Paris (11.6%), Berlin (10.8%), Amsterdam (7.3%), Warsaw (7.0%), Milan (4.7%), Budapest (2.9%), Prague (2.7%) and Munich (2.4%).

“We can already feel the intensified interest towards Budapest here in Cannes. We are delighted, that we could add our part to our capital town’s proper appearance on MIPIM, the world’s largest property market.” – commented Lóránt Kibédi Varga, CEO of CBRE’s Hungarian office sharing his fresh experiences directly from the market.

Across the more traditional sectors, offices remained the favourite asset type with 37% of the responses. However it was residential assets which saw the biggest increase in investor interest, growing from 5% of preferences in 2015 to 12% in 2016. Retail also fared well, and the recovery of consumer confidence and consumer spending has resulted in the proportion of respondents choosing retail increasing from 22% in 2015 to 27% in 2016.

The search for yield, as mentioned with regard to CEE, was also apparent in respondents’ answers to the “alternative” sector. 56% of all respondents were already invested in one or more alternative sectors, and 57% were actively looking in one or more of these sectors. Real estate debt is the segment that currently has the most market penetration with over 30% of investors already having some exposure and 22% actively looking for further investment. Student Housing was the segment which attracted the most new interest. 20% of respondents already have investments in this area with most of these seeking further exposures. However there are a further 13% of respondents who are looking to invest in student housing for the first time.

At CBRE Hungary Investment Breakfast to be held on 5th April 2016 a survey will be carried out about the Hungarian Investment market with investors and fund/asset managers.

CBRE