Europe’s largest oil companies are now placing greater emphasis on upstream activities, namely exploration and production, shifting focus from downstream retail activity, by exiting from less profitable real estate sites.

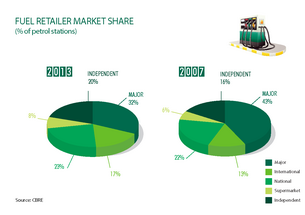

Such divestment by major oil companies is creating opportunities for independent petrol retailers, who now own exactly 20%, of all petrol filling stations across Europe, compared to 16% in 2007. Across the same period major oil companies’ market share decreased 11%, from 43% in 2007 to 32% today.

This trend is most pronounced in less mature European markets, with independent petrol retailers having the strongest foothold in Bulgaria, where they account for almost two thirds of filling stations at 64%. In Czech Republic the figure is 56%, and over a third of petrol filling stations have been acquired by independents in Hungary, Belgium, Poland and Romania.

In Hungary rental levels and sale prices seemed to stabilize in 2012 after a significant drop was reported in previous years. Rental interest remained focused on prime urban locations whilst sales occurred in regional and motorway locations.

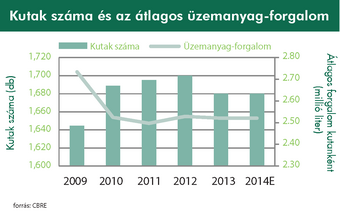

The top five fuel retailers by fuel volume sales accounted for 61% of the Hungarian service station network in 2012. MOL accounted for 22% of the national network. All big oil companies have been downsizing and optimising their retail networks. Verdict predicts that the number of service stations in Hungary will decline by 1.2% in the foreseeable future.

Agip announced that they will be evaluating the performance of their portfolio in 2013 with a view to optimising performance. Shell closed 17 sites in 2012 and 14 in 2013. Announcements were made earlier this year that more sites will either close or sell in the near future. OMV closed ten sites in 2012 with 170 remaining. MOL closed four sites in 2012.

'White stations' (stations free of supply tie, which can negotiate the price at which they buy fuel) like Oil! and Dallas have been expanding, taking over stations divested by the major operators.

Service operators reported decreasing shop turnover in 2012, attributed to higher fuel prices. It is expected that the recently introduced tobacco concession regulation will affect service station turnover negatively. The government’s decision for tobacco products to be sold only at authorized shops has meant that many stations would lose a chunk of their turnover. For instance, out of MOL’s 360 stations in Hungary, only 25 won a concession to sell tobacco under

the new legislation. MOL has announced that it is looking for tobacco concession winner partners to set shop at 200 of their locations.

Hypermarket chain Auchan, which operates service stations under its own brand, announced plans to build more stations at its existing hypermarkets, including the seven Cora stores they acquired in 2012.

CBRE