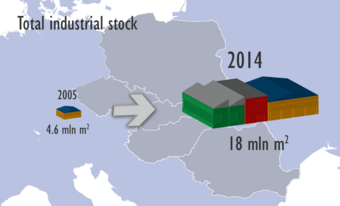

“This is a strong decade for industrial property. The industrial sector in Central Europe is backed by above-average GDP growth – ten years ago the average for Central European countries was approximately 52 per cent of the EU average, but now it’s 68 per cent. Central Europe has made great progress and is set to grow further,” says Ferdinand Hlobil, Head of the Central European Industrial Team at Cushman & Wakefield.

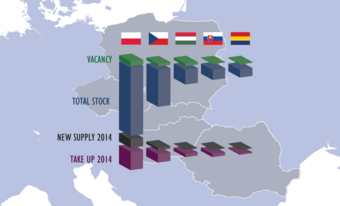

Vacancy

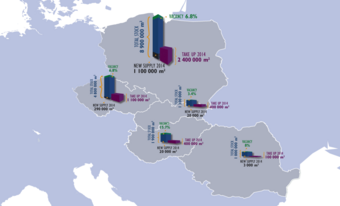

Vacancy for industrial property in Central Europe is now less than 8 per cent, and an inflow of new tenants has resulted in demand for new development. Five years ago vacant space accounted for approximately 15 per cent, while in 2005 it was a little over 9 per cent.

“Vacancy reflects the economy: the lower this indicator, the better the economy is doing. Falling vacancy indicates rising demand for leasing industrial property. Hungary has made the most progress over the last twelve months, with the vacancy rate dropping by 6 per cent. Slovakia has maintained the lowest vacancy rate, currently slightly over 3 per cent,” says Ferdinand Hlobil.

New development

Over 1.4 million sq m of new space for leasing was built in 2014, marginally above the average for the decade as a whole (1.3 million sq m). Poland led the way in 2014 with more than 1 million sq m built. During the last ten years Poland built in excess of one million sq m in 2007, 2008 and 2014.

Take-up

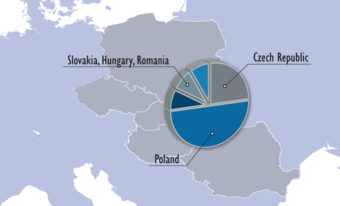

In 2014 the take-up volume rose to 4.4 million sq m, approximately half a million sq m more than the record set in the previous year. Over the long term three-quarters of all leasing – calculated as the number of square metres leased – has been in Poland and the Czech Republic, with the remaining quarter in Hungary, Slovakia and Romania. We expect this ratio will be maintained for some time to come.

Outlook

“The industrial property market in Central Europe is already fairly large, and it doesn’t need more unlimited expansion. We anticipate that in the longer term construction may collide with municipalities’ plans, which will favour revitalising built-up areas. New development will be therefore more deliberate,” says Ferdinand Hlobil.

In the coming years new annual construction in Central Europe is forecast to be between 750 and 1,250 thousand sq m. Hungary, Romania and Slovakia have relatively large potential for development; in the past they saw less building, and the stock of industrial parks for leasing is lower than in Poland and the Czech Republic.

“For example if we compare Hungary and the Czech Republic, then both countries have roughly the same population, but in Hungary there is less than 2 million sq m of industrial space for leasing, while in the Czech Republic the figure is almost 5 million sq m. And the Hungarian market is becoming livelier as new developers home in on the country,” says Ferdinand Hlobil.

The industrial properties were extremely attractive also for the investors; in the CE region they invested EUR 1,85 billion in 2014. However, the investment sector offers room for change. In Central Europe industrial property is almost exclusively owned by foreign developers and funds. Local real estate pension funds are not particularly well established in Central Europe at present, and we see room for growth here.

Cushman